A. Introduction

Business recently is in uncertain and competitive condition,

neither in large or small scale of industries. Every company seems to apply its

strategies to win the competition in the market. Therefore, reliable

information about cost is very important for decision making. Companies that

can effectively gather and spread relevant information to all their departments

might be successful to be great companies in the world (Compton, 2009). One

thing that should be considered is about efficiency. In order to know how to

improve efficiency, companies need to know information related to the costing

method implemented to production activities, so they can identify each cost

appropriately.

Costs can be divided into direct costs and

indirect costs or overheads. Direct costs are easier to be assigned to cost

objects than indirect costs because direct costs can easily be traced to

particular cost objects, while indirect costs cannot. Assigning process of

indirect costs involves cost allocation of resources that are consumed in

company activities. There are two costing system that can be applied, direct

costing system, which only assigns direct costs to cost objects, and absorption

costing system, which assigns direct and indirect costs to cost objects.

Absorption costing system can be divided into Traditional Costing Systems and

Activity Based Costing (ABC) System (Drury, 2013).

B. The Purposes of Calculating Full

Absorption Product Costs (Absorption Costing System)

There are two purposes of assigning costs to products by

manufacturing companies, for financial accounting and managerial

decision-making. Full absorption costing focus on the second purpose because it

more concern on providing useful information for managers, so managers

understand accurately the costs that are required by each product and then they

are able to determine whether a product is profitable or not. Therefore, if

managers can identify the resources consumed by products, they will be able to

pinpoint the source of profits or loses, and then make appropriate decision

(Drury, 2013).

If a company manufactures only one kind of

product, all of costs can be directly assigned to the product. In fact,

however, costing systems rarely assign costs straightforward because companies

often produce different products that use several common resources in different

proportions. All production costs should be shared to products in an

appropriate manner (Innes and Mitchell, 1990). In this case, a well-designed

costing system, such as absorption costing system, is needed.

Absorption costing system assigns all of

costs related to production process, such as direct materials, direct labour,

and overhead (variable and fixed overhead). This method offers wider scope of costs

than direct costing because it assigns not only direct costs, but also indirect

costs. Therefore, manager will get more comprehensive information about

production costs for decision making.

C. Traditional Costing and Activity Based

Costing (ABC) System

1. Traditional Costing

System

Traditional costing system allocates indirect costs or overheads

based on volume, such as direct labour hour or production machine hour (Mark,

2009). There are two stages of cost allocation in traditional costing system.

In the first stage, all manufacturing indirect costs (overheads) are assigned

to production and service cost centres, then the cost assigned to service cost

centres are reallocated to production cost centres. Subsequently, in the second

stage, each overhead rates are computed and assigned to cost objects or

products (Drury, 2013)

Traditional costing system has only one or

few overhead cost driver for each department in a company. This system assigns

costs directly to products, instead of activities associated with production.

In this system, the total costs which are incurred to produce a number of

products are divided among various products in volume basis, where the cost

drivers are often financially based (Mark, 2009). Besides that, traditional

costing system negates non-manufacturing costs that might also relate to

production of a product such as administrative expenses (Johnson, 2015). Those

disadvantages can lead managers to mistakenly believe in profitability of their

products. In other words, this system often gives misleading information for

managers in decision making.

2. Activity Based Costing

(ABC) System

Activity Based Costing (ABC) System assigns costs based on

cause-and-effect relationship between the costs and the activities driving the

costs (Kumar and Mahto, 2013). The activities consist of various task, events,

or works, such as setting up machines, purchasing material, inspecting items,

and processing orders from customers (Drury, 2013).

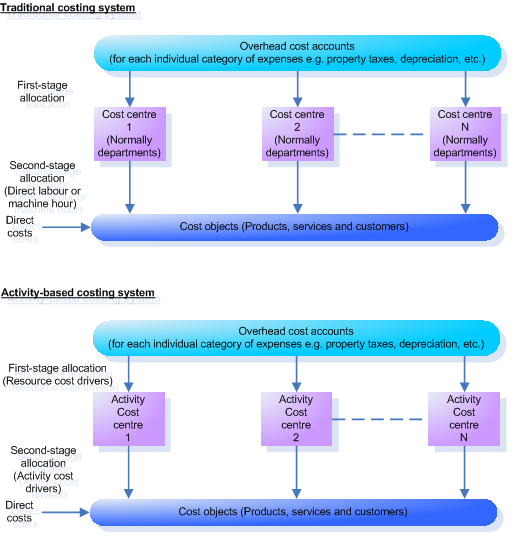

Comparison between traditional and ABC

system can be seen in Figure 1. ABC system also uses two-stage allocation

process. However, ABC system use many activity cost centres (activity cost

pools), while traditional system pools overheads by departments. Furthermore,

ABC system not only use volume-based cost drivers, like traditional system, but

also non-volume-based cost drivers, for example number of set-ups. ABC system

can more accurately measure consumption of resources by cost objects because

ABC system use a large number of cost centres and variety of second-stage cost

drivers, and assign activity costs to cost object based on cost driver usage

(Drury, 2013).

Figure 1. Comparison between Traditional

Costing and ABC System

Source: Drury, C (2013) Management

Accounting for Business 5th edition

Changes in technology, competition, information associated with

costs, and demands for variety of products from customers, impact necessity to

improve costing system to be more sophisticated. ABC system offer more accurate

product costs and reduce distortion of information of product cost from

traditional costing system (Cooper, 1988b and Kaplan, 1994, cited in Al-Omiri

and Drury, 2007, p.400).

ABC system is often considered more useful

than traditional costing system. Kumar and Mahto (2013) summarized some

positive points of ABC system. First, ABC provides more accurate data and

detailed information on all activities and processes in company, compared to

traditional costing system. In this case, ABC enables managers to improve

financial performance by managing cost effectively. Second, ABC reflects

company’s performance, so it can be a benchmark for business performance

compared to the competitors. Finally, ABC not only can be implemented in

manufacturing, but also in distribution, agriculture, and service business.

Johnson (2015) also stated that the main advantages of ABC system is the

accuracy because it negates irrelevant cost and gives greater understanding for

internal manager regarding production costs.

D. Activity-Based Management (ABM)

Activity-based management is a cost management for application of

ABC system. ABM concerns in managing business based on activities in the

organisation. It needs an understanding about factors that cause activities and

that lead changes of cost incurred in activities. ABM also provides information

about activities that involve more than one department. For instance, the

activities related to customer’s orders can be evaluated from production and

distribution departments. Furthermore, ABM enables managers to identify costs that

can be potentially reduced by classifying activities into value added and

non-value added activities. Managers can focus on reducing costs in non-value

added activities, because it will not decrease the quality of product’s service

to the customers (Drury, 2013).

ABM is necessity in implementation of ABC

system. ABC system requires high efforts and costs, so it should be well

managed, otherwise it will lower company value. The most common mistake is that

companies tend to more focus on ABC system and lack of concern in ABM (Bahnub,

2010).

E. Adoption of ABC System in UK Companies

Costing systems can be classified by level of sophistication based

on the dimensions such as the number of cost pools, the number of various

second-stage cost drivers, the types of cost drivers that are used in the

second stage, and the usage of resource drivers in the first stage. High level

of sophistication is associated with high number of those dimensions, and vice

versa. Then, the level of sophistication is considered in determining costing

system that would like to be applied (Al-Omiri and Drury, 2007). Relationship

between level of sophistication and appropriate costing system can be seen in

Figure 2.

Al-Omiri and Drury (2007) hypothesized that several factors

influencing level of sophistication are the importance of information about

costs, diversity of product, cost structure, intensity of competition,

organisation size, the quality of IT, techniques of innovative management

accounting and production, and business sector. As the result, most of those

factors showed significant influence on implementation of Activity Based

Costing System, except the quality of IT, diversity of products, and cost

structure.

Figure 2. Relationship between Level of Sophistication and Costing

System

Source: Al-Omiri,

M and Drury, C (2007) A Survey of Factors Influencing the Choice of Product

Costing System in UK Organisations

In another study, Drury and Tayles (2005) examined factors or

variables considered to select product costing in organisation by its level of

complexity. Level of complexity is associated with the number of cost pool in

the first stage, the number of different types of cost drivers in the second

stage, and the nature of cost drivers. The dimensions of costing system

complexity can be seen in Figure 3.

The factors examined are the cost structure, competition,

diversity of products, degree of customization, size, importance of cost

information to make decision, and corporate sector. The result was that only

corporate sector that has significant influence to the complexity of costing

system. It was likely because the financial, commercial and service

organisation have high proportion of indirect costs compared with other

organisations such as manufacturing organisation (Drury and Tayles, 2005).

Figure 3. Dimensions of Costing System

Complexity

Source: Drury, C and Tayles, M (2005)

Explicating the Design of Overhead Absorption Procedures in UK Organizations

Those finding may explain why the adoption rate of ABC system is

quite low. According to the survey to the UK largest companies, the ABC system

has been adopted only around 15% of the companies surveyed (Drury and Tayles,

2005). So far, many researches have not been able to prove strong link between

contextual factors identified and adoption of ABC system (Al-Omiri and Drury,

2007).

In fact, even though ABC system gives some

benefit to company, it also has some drawbacks. Johnson (2015) admitted that

ABC system requires great resource, so it will be difficult for companies that

have limited funds. The cost needed to implement and operate ABC system is much

more expensive than traditional system. Besides that, the lack of understanding

of ABC system can lead some users to be easily misinterpreted. Compton (2009)

also explained that it is difficult to precisely trace activity costs to

specific products because some activities may be related to many products.

Those disadvantages might also lead many companies to not use ABC system.

F. ABC System in Financial and Service

Organisation

Drury and Tayles (2005) suggested that financial and service

organisations are likely to adopt ABC system because they have more complex

indirect costs than manufacturing organisations. Financial and service

organisations have more indirect cost than direct costs in their cost

structure.

Chea (2011) stated that financial organisations have been leading

in implementing ABC system. They acknowledge the benefit of ABC system. For

example, large regional banks implement ABC system for resource allocation and

pricing effectively. The banks expect that the costs charged to the customers

are based on effort-and-use relationship. In global insurance company, ABC

system has been implemented to determine allocation methodology for transfer

pricing among their affiliates. The companies want to make sure that costs

charged in all of their affiliates around the world are accurate. The costs

incurred in the services that are provided to all affiliates can be traced

through ABC system. Furthermore, the companies have been able to reduce its

effective interest rate. Another example of implementation of ABC system is in

major investment banks. Through ABC system, they are able to determine the

profitable products and markets, and then influence their business strategy.

Besides that, ABC system leads them to improve their internal performance

measures and make changes in their internal transfer pricing.

Ruhl and Hartman (1998) pinpoint the

benefit of implementation of ABC system in service companies. For example, in

financial service companies such as bank, the costs are driven by number of

transactions, not by the volume (the number of customers). Therefore, activity

based costing is more appropriate than volume based costing. In healthcare

business, such as hospitals, companies set their revenue with Prospective

Payment System (PPS) which lead improvement in sophistication of their costing

system. This can be accomplished by ABC system. The insurance business also uses

ABC system to improve their performance. ABC system enable them to evaluate the

costs caused by the time consumed in the tasks, which are vary depend on the

case.

G. Conclusion

ABC system provides more accurate cost

information than traditional costing system, so it helps managers in decision

making. It becomes more increasingly and significantly important for companies

in more competitive market because it enable managers to control their costs to

make competitive pricing and increase profitability. Despite the fact that ABC

system offers many advantages, this system requires high costs and resources.

The adoption rate of ABC implementation is also quite low. ABC system is more

likely to be implemented in financial and service organisations because their

indirect costs are more dominant and complex than manufacturing organisations.

References

Al-Omiri, M. and Drury, C.

(2007) A survey of factors influencing the choice of product costing systems in

UK organizations. Management Accounting Research, 18 (4): 399-424

Bahnub, B. (2010)

Activity-based management for financial institutions. Hoboken, N.J.: John Wiley

Chea, A. (2011) Activity-Based

Costing System in the Service Sector: A Strategic Approach for Enhancing

Managerial Decision Making and Competitiveness. IJBM, 6 (11)

Compton, T. (2015) CPA

Journal Online [online]. Available from:

http://www.nysscpa.org/cpajournal/1996/mar96/features/implementing.htm

[Accessed 20 March 2015]

Drury, C. (2013) Management

Accounting for Business. 5th ed. Andover: Cengage Learning EMEA

Drury, C. and Tayles, M.

(2005) Explicating the design of overhead absorption procedures in UK

organizations. The British Accounting Review, 37 (1): 47-84

Innes, J. and Mitchell, F.

(1990) Activity based costing. London: Chartered Institute of Management

Accountants

Innes, J., Mitchell, F. and

Sinclair, D. (2000) Activity-based costing in the U.K.’s largest companies: a

comparison of 1994 and 1999 survey results. Management Accounting Research, 11

(3): 349-362

Johnson, R. (2015)

Traditional Costing Vs. Activity-Based Costing [online]. Available from:

http://smallbusiness.chron.com/traditional-costing-vs-activitybased-costing-33724.html

[Accessed 20 March 2015]

Kumar, N. and Mahto, D.

(2013) Current Trends of Application of Activity Based Costing (ABC): A Review.

Global Journal of Management and Business Research Accounting and Auditing, 13

(3): Version 1.0

Martin, J. (2015)

Activity-Based Costing in the Service Sector [online]. Available from:

http://maaw.info/ArticleSummaries/ArtSumRuhlHartman98.htm [Accessed 20 March

2015]

Marx, C. (2015) Activity

Based Costing (ABC) And Traditional Costing Systems [online]. Available from:

http://financialsupport.weebly.com/activity-based-costing-abc-and-traditional-costing-systems.html

[Accessed 20 March 2015]

0 comments:

Post a Comment